Very first, the brand new code might possibly be put out less than a business Resource License step 1.1, and therefore limits the economical otherwise production utilization of the V4 supply code for as much as couple of years. After this months, it can become a GPL license, ensuring continuous unlock-resource Uniswap app entry to. EIP-1153, if the implemented as part of an Ethereum inform, you’ll give more extreme energy discounts and you may cleaner package designs so you can Uniswap V4 along with other programs on the Ethereum environment. Uniswap V4 intends to end up being a-game-changer, providing a range of additional features, optimizations, and you may opportunities having the potential so you can redefine the way we work together with DeFi. This isn’t the very first time a16z has used its determine so you can move a vote in favor.

It’s value noting that this transform prefers more capable field manufacturers over pupil people. Using this type of additional coating away from difficulty, quicker effective LPs get earn shorter in the trading fees than just top-notch professionals just who enhance the approach continuously. Uniswap v4 raises the fresh “singleton” ability in which an individual wise offer oversees all the swimming pools in the method.

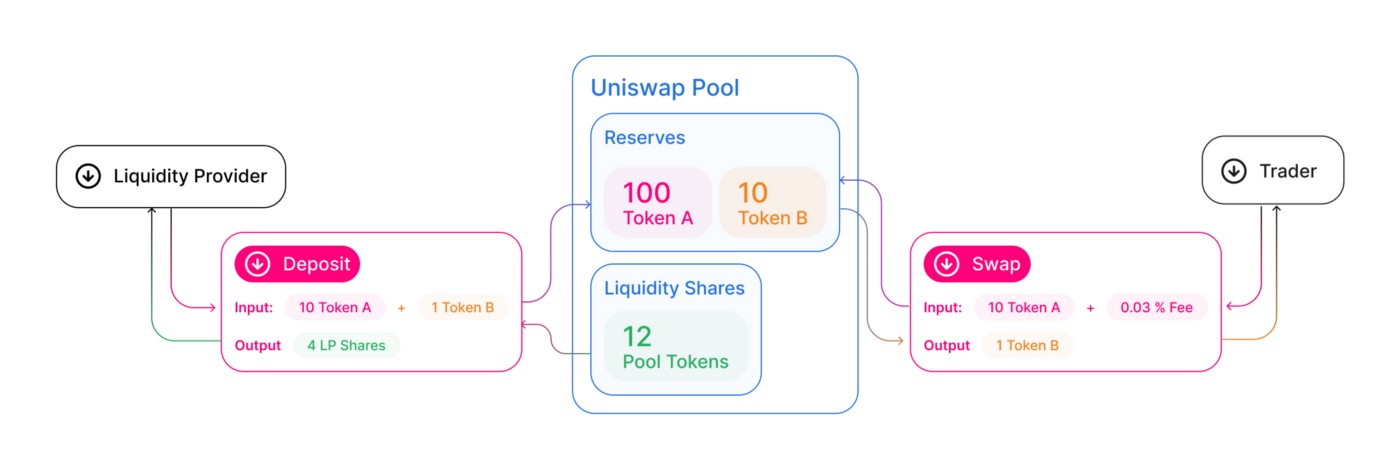

Indigenous ETH assistance takes away a lot of conversions, next cutting costs. Uniswap V4 has the new centered liquidity model of V3 but substitute independent pond deals that have a great singleton bargain, cutting energy will set you back. Moreover it have thumb accounting, reducing a lot of token transmits, and native ETH support, eliminating the necessity for wrapping ETH. Uniswap V4 is actually a primary inform for the Uniswap decentralized exchange that is set to change the newest DeFi field by the starting the newest and improved has for the process. Uniswap V4, that’s however inside the invention, is built by wide Uniswap people. Once launched, Uniswap can get private usage of its V4 designs for four many years, but all code would be produced open-supply eventually.

Rather than after the tight variables, pools can become designed to certain requires. Also, for each liquidity pool in the v3 turned into a different wise deal. While this improved self-reliance, moreover it led to significantly highest gas costs. Singleton and you may thumb bookkeeping permit more effective and less expensive routing across the several pools. Due to the regarding “hooks” do help the quantity of exchangeability swimming pools, which work with is very of use. In a few sense, Uniswap v3 is actually a standard technique for performing an on-chain buy book for the Ethereum, where field manufacturers can choose to include liquidity in cost range of its possibilities.

Uniswap app – Singleton Structures and you will Energy Savings: A Thinner, More effective Uniswap

Uniswap V4 is actually subscribed less than a business Origin Licenses (BUSL), restricting commercial otherwise creation entry to the origin code until June 15, 2027, if it transitions to an MIT permit. Uniswap Governance is offer conditions to the BUSL due to Additional Play with Has, the same as Uniswap V3. Uniswap V4 regulates native ETH change, eliminating the need to link and you can unwrap ETH on the WETH.

Hooks

Uniswap V4 not merely pros users and also reveals potential to possess liquidity team (LPs). For example, hooks can use get off costs in order to remind enough time-term liquidity supply, performing more stable pools. Previous Uniswap versions lacked lead ETH support, having fun with covered ETH (WETH) to have ETH-associated exchanges. Uniswap v4 now myself supporting ETH, allowing profiles to help you trading ETH to have tokens rather than WETH.

- Uniswap V4 usually work to help expand identify the two platforms by the delivering builders to your devices necessary to create harder and you will nuanced pool versions.

- The new process works to your discover-origin smart contracts, and therefore all purchases is transparent and permanent, reducing the need for middlemen.

- Brought after 2023 with an initial price out of 0.15%, this type of charge was risen to 0.25% inside the April 2024, a performance one to remains in force even today.

- A stable Equipment Market Creator (CPMM) model is employed to choose the price of possessions within the a great exchangeability pool.

- Which flow slash energy costs and you may hasten transactions, making Uniswap inexpensive and you will accessible to a larger list of profiles.

Exactly what are Active Fees?

This might have more people, improving liquidity and you may boosting exchange requirements. When the detachment charge is let, governance may also put maximum part of those individuals fees. Although not, as opposed to within the v3, fee tiers and tick spacings are not lower than governance manage inside the v4. The fresh UNI DAO is also vote to implement a protocol fee to own one pool within this certain predefined limitations. However, Uniswap v4 streamlines this course of action with one offer one to manages all of the swimming pools along. These improvements not only work for Uniswap profiles but also sign up for the entire development and growth of the DeFi environment from the form the brand new performance and you may consumer experience requirements.

The newest flash accounting system tracks the web balances out of tokens moving inside and outside through the a purchase. If they are not, the order is totally reverted, making sure protection and you can results. This concept is like flash fund and that is section of Uniswap’s broader energy to lower gas will cost you and you may boost purchase results. Transient shop work such as regular stores however, automatically clears analysis during the the conclusion for each deal.

Uniswap v4 is here now – A new Era of DeFi

If you are Uniswap V1 try groundbreaking, it got their limits, as well as inefficiencies within its costs formula that might be taken advantage of from the arbitrageurs, and you can large slippage to possess high-regularity purchases. Uniswap has been through some iterations, starting Uniswap V2 within the 2020 and you can Uniswap V3 in the 2021. Within the Summer 2023, Uniswap released the new write code to possess Uniswap V4, with biggest the newest functionalities.

Because the underlying buildings spends a callback program to own exchanges, builders can still use the Common Router to do swaps for the v4 pools, just as you’ll to own v2 otherwise v3. Per successive sort of Uniswap provides offered more complex pond has, and v4 will require one to to some other height. When you are great for liquidity, pond customizability managed to get hard to find swappers the suitable channel who does provide them with the best speed.

So it version delivered the brand new Ongoing Unit Field Founder (CPMM) model, and this diverged away from antique order guide-based options. Unlike depending on purchase matching, Uniswap V1 invited you to definitely pool their tokens, doing liquidity swimming pools for various token sets. Without yet officially launched, the newest visionary design prices and you may tech upgrades of Uniswap V4 have already been mocked due to code drafts and whitepapers. A standout function ‘s the regarding “hooks,” which enable designers so you can extremely customize liquidity swimming pools in their entire lifecycle.

This guide concentrates on tips relate with Universal Router from an in-strings deal. The newest Common Router uses a new encryption system for the purchases and you can enters, that is crucial to know when setting it up to own v4 swaps. Locating the best you are able to channel utilizes how greater exchangeability coverage try. The more exchangeability we know on the, the more alternatives we could need to find a very good channel. The fresh Uniswap car-router, DEX aggregators, and you will meta-aggregators are well-known for this direct reasoning — he has wider liquidity publicity.

Uniswap v4 raises hooks to create individualized automated market maker (AMM) features, such continual investments otherwise oracles. UniswapX outsources routing complexity to an open circle of third-team fillers just who then compete to find the best price across the liquidity source. Together, this type of subservient protocols help render pages an informed swapping sense.

Constructed on the brand new OP pile, they aims to render quick transactions having very first clogging days of you to definitely next, that may ultimately become quicker so you can 250 milliseconds. The fresh Uniswap V4 try governed because of the Uniswap Laboratories, for example their earlier incarnations – V1, V2, and you may V3. However, Uniswap Labs is not the merely power behind V4, since it is based alongside the Uniswap decentralized independent business (DAO) plus the Uniswap community. The newest Uniswap people contains UNI token holders just who suggest the fresh ideas to produce the fresh method advancement and you may vote for the very important conclusion.